Are you struggling to understand the intricacies of Medicare supplement underwriting? You’re not alone. Navigating the insurance world can be daunting, but fear not – we’ve got you covered. In this medicare supplement underwriting cheat sheet, we’ll unlock the secrets of insurance underwriting for Medigap policies. We’ll make it easier for you to understand and find the coverage that meets your needs.

Are you struggling to understand the intricacies of Medicare supplement underwriting? You’re not alone. Navigating the insurance world can be daunting, but fear not – we’ve got you covered. In this medicare supplement underwriting cheat sheet, we’ll unlock the secrets of insurance underwriting for Medigap policies. We’ll make it easier for you to understand and find the coverage that meets your needs.

Whether you’re new to Medicare or have been enrolled for years, underwriting can be confusing. But it doesn’t have to be. We’ll break down the process step-by-step, explaining the factors that insurers consider when determining your eligibility and pricing for Medicare supplement plans. From medical history and pre-existing conditions to age and location, we’ll leave no stone unturned.

Armed with this knowledge, you’ll be better equipped to navigate the Medicare supplement landscape and make informed decisions about your coverage. So, grab your pen and paper, and let’s create your own Medicare Supplement underwriting cheat sheet together. By the end of this cheat sheet, you’ll feel confident and empowered to take control of your healthcare coverage.

Develop Your Own Cheat Sheet for Medicare Supplement Insurance & Underwriting

Medicare supplement insurance, also known as Medigap, is designed to fill the gaps in original Medicare coverage. While original Medicare covers many healthcare expenses, it doesn’t cover everything.

Part A currently has a hospital deductible of $1,632 per event in a 60-day period, and Part B has an unlimited 20% coinsurance. That’s why you need a Medicare supplement policy to fill in the gaps.

Private insurance companies offer these policies to help you pay out-of-pocket costs such as deductibles, copayments, and coinsurance. How do you get a Medicare Supplement policy?

The Basics of Insurance Underwriting

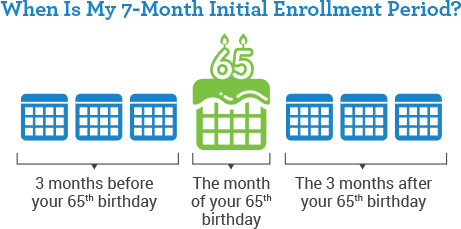

During your Initial Enrollment Period into Medicare, the insurance company is required to sell you a Medicare Supplement without asking any health questions–underwriting. After your one-time Initial Enrollment Period into Medicare, you will need to answer health questions and pass underwriting to purchase a Medicare Supplement in most states.

Underwriting is the process insurance companies use to assess an applicant’s risk and determine eligibility for coverage. When it comes to Medicare supplement insurance, underwriting plays a crucial role in determining whether you’ll be approved for a plan and how much you’ll pay in premiums.

When people are denied during underwriting or rated, they are usually not happy. Some people are even upset and offended. I understand. I get rated as obese myself under most insurance underwriting. I’ve been lifting weights since I was twelve, so there is plenty of muscle. But guess what? My body fat is not 6%, either, so I’m fat. So, I pay more. I am working hard on trying to grow taller for my weight category. So far, it has yet to work.

Of course, the people who pass underwriting are happy, but they should be happy because others were not allowed into their insurance pool. Because a certain level of health is required, the number of clients can be covered with an affordable amount of premium. You want as low a number of claims as possible because that keeps your premiums low. The same goes for car insurance, homeowners insurance, and boat insurance. When there is a natural disaster, like hail or hurricanes, that is why premiums usually go up afterward.

Sometimes, actuaries get the underwriting wrong because insurance companies WANT to insure more people. The more people they insure; the more money they make usually–if they do it correctly.

When they do it incorrectly–in other words, poor underwriting standards–the result is that people with potential health issues get into the pool. There are more claims than what the actuaries planned for, and the insurance company must make up the difference by increasing premiums for everyone.

Why Underwriting is Important in Medicare Supplement Insurance

Underwriting is necessary in Medicare supplement insurance because it helps companies manage risk. By assessing an applicant’s health status and other factors, insurers can determine the likelihood of the individual filing claims and estimate the potential costs they may incur. This allows them to set appropriate premiums that reflect the risk level the insurance company is taking on.

Factors Considered in Medicare Underwriting

Factors Considered in Medicare Underwriting

Here is the meat of what you are looking for. During the underwriting process for Medicare supplement insurance, several factors are taken into consideration. These factors can vary slightly depending on the insurance company, but some common ones include:

1. Age: Younger individuals may be seen as lower risk than older individuals with more health issues.

2. Gender: Although gender-based pricing is not allowed in some states, it may still be a factor in underwriting. In Nebraska & Iowa, Medicare Supplements are priced based on gender, and men are always more expensive.

3. Location: The area where you live can impact the cost of healthcare and, therefore, affect underwriting decisions.

I mainly do Medicare insurance in Nebraska and Iowa. I’m amazed at the price differences between Nebraska and Iowa, Omaha and Lincoln, and urban and rural areas. Ultimately, some areas are healthier than others and consequently have fewer claims. Thus the premiums are lower.

4. Medical history: Insurance companies will review an applicant’s medical history to assess pre-existing conditions and potential risks. As part of the application process, you give the insurance company permission to access various insurance resources that give a history of your health. You list your current medications and the dosage on the application. Medications tell a great deal about your health profile.

5. Tobacco use: Smokers may face higher premiums due to the increased health risks associated with smoking. Some companies do not count you as a smoker during your Initial Enrollment Period into Medicare. We definitely highlight these companies to our new clients who are smokers.

6. Enrollment period: The timing of your application can impact underwriting decisions, as there are specific enrollment periods where guaranteed issue rights apply. This particular issue is NOT relevant to Medicare supplements in Nebraska and Iowa. There are no special periods, like the birthday or anniversary rule.

Common Underwriting Requirements

Insurance companies may require applicants to go through underwriting when applying for Medicare supplement insurance. The underwriting requirements can include:

Medical Underwriting

This involves answering health-related questions on the application form. People always ask if there is a physical; there is no physical. The health questions only take 5-8 minutes to answer. The medical side of underwriting is all done electronically. In a moment, insurance companies can scan your medical records and prescriptions to make a determination. Some companies have the whole process so automated that I get an answer within seconds.

Pre-existing Conditions

Insurance companies may ask about pre-existing conditions and impose waiting periods or exclusions for specific conditions. For example, most health questions begin with a qualifier: “In the past two years . . . .” “In the last six months . . . .” “Do you take _____ amount of insulin?”

Just because you had cancer in the past, a heart attack in the past, or a stroke in the past, you are NOT automatically disqualified. The bigger questions is how longer go did it occur, what has been your health since, and was the problem rectified?

Guaranteed Issue Rights

There are specific situations where insurance companies must offer coverage without underwriting, such as when an individual is losing other health coverage. There are restrictions; for example, you can only select Plan G.

Medicare regulations in Nebraska and Iowa only have a Medicare guarantee issue for when you lose an employer health plan and are on Medicare. Nebraska & Iowa do not have a Medicare Supplement Open Enrollment.

How Medicare Underwriting Impacts Premium Rates

Underwriting can significantly impact the premium rates you’ll pay for your Medicare supplement insurance. Based on the information gathered during the underwriting process, insurance companies determine the level of risk you represent and adjust your premiums accordingly. If you’re considered a higher risk, you may face higher premiums, while lower-risk individuals may enjoy more affordable rates. In some cases, the risk is too high, and the company denies coverage.

Implement Your Medicare Supplement Underwriting Cheat Sheet

Navigating the underwriting process for Medicare supplement insurance can seem daunting, but by developing your own medicare supplement underwriting cheat sheet, you can increase your chances of success.

Research and Compare Plans

Before applying, research and compare different Medicare supplement plans to find the one that best suits your needs. We do hundreds of Medicare Supplement applications a year. We know the companies that are strict or more lenient. Some companies will cover insulin-dependent diabetics; many will not. We know the levels of A1C that are acceptable to some insurance companies and will be rejected by others. Rheumatoid arthritis is immediately rejected by some companies but is allowable under certain circumstances by others. Each company picks its segment of the market it wants to go after and specialize in. We help our clients find the needle in the haystack.

Understand the Underwriting Process.

Familiarize yourself with the underwriting requirements of different insurance companies so you know what to expect during the application process. Understanding the process may be as simple as losing a few pounds. That will get you into a better health class and a lower premium.

Adjust your diet and then visit your doctor to have your blood tested. Reduced cholesterol or A1C levels may be enough to push you into the next underwriting category.

Be Honest and Accurate.

Provide truthful and accurate information on your application to avoid any complications or potential issues later on. They will know if you are a smoker. You will not be able to avoid the smoking rate by not disclosing tobacco use, even chewing.

Seek Professional Assistance

If you’re unsure about the underwriting process or need help with your application, consider contacting a licensed insurance agent professional or broker specializing in Medicare supplement insurance.

At Omaha Insurance Solutions, we know the landscape of Medicare Supplements in Nebraska and Iowa. We can direct you to the plan that will be most favorable to your health circumstances and budget, especially if you have some health challenges. Insurance professionals do not cost you anything. The price is exactly the same if you do all the work yourself or use an insurance agent. Why not use someone who has a thorough knowledge of the plans in your area? Give us a call at 402-614-3389.

Common Underwriting Mistakes to Avoid

When going through the underwriting process for Medicare supplement insurance, it’s essential to avoid common mistakes that could potentially lead to application denials or higher premiums.

Providing incorrect information

Ensure that all the information you provide on your application is accurate and current.

I have clients who are “too honest.” They think if they explain and justify certain health issues, the insurance company will understand and forgive. In my experience, when the underwriter hears certain words and phrases, they sometimes overreact. As scientific as they try to make it, underwriting is still a very human process. It is the job of the underwriter to protect the insurance company. We then have to contact the doctors and go through a difficult and lengthy process to explain the health situation so the person is passed through underwriting.

underwriting is still a very human process. It is the job of the underwriter to protect the insurance company. We then have to contact the doctors and go through a difficult and lengthy process to explain the health situation so the person is passed through underwriting.

My recommendation is like Sergeant Joe Friday used to say, “Just the facts, mam, just the facts.”

Failing to disclose pre-existing conditions

Be thorough when disclosing any pre-existing conditions, as failure could result in coverage denial or exclusions. They will find everything. I guarantee.

Where this situation becomes sticky is with surgeries. One of the questions that is on every application is: “Has a medical professional recommended you have any surgical procedures?” Or, “Do you have any medical procedures scheduled, such as cataract, joint replacement, or hip replacement surgery?” Or words to that effect.

The new insurance company does not want to get stuck with a surgical bill that should go to the existing insurance provider. After the surgery is completed and you are fully recovered, then you can proceed along with the application.

If you are not forth coming with that information and you do have a surgical procedure done after going on the new policy, like cataract surgery, the insurance company is in a position to say that you were not honest on the application. Then they will deny the claim. You will then be responsible for the full cost out of your pocket.

Honesty Is the Best Policy

Over the years, I have had prospective clients not disclose important information, “forget,” or lie. “I forgot the doctor said I have a mild case of Alzheimer’s.” “I only smoke once in a while.” “The cancer is really slow growing. The doctor said it’s tiny.” “I didn’t know it was COPD. I thought it was bad asthma.”

While I’m sympathetic to harsh medical circumstances and the desire to reduce insurance costs, it doesn’t alter the reality they will not be offered a new Medicare Supplement. The whole endeavor ends up being a waste of time for everyone involved.

Fortunately, systems are in place where insurance companies are almost infallible in finding out medical history. That is a good thing because if a policy were issued under materially false circumstances, the person who made false or misleading claims would be in serious financial hazard. The process protects everyone involved.

Not Reviewing Your Application

Review it carefully before submitting it to ensure all the information is correct and complete. When an application is denied by an insurance company, there is a record.  Even if there was a mistake made in the application process, it is not as simple as reapplying with the same insurance company or another. Depending on the situation, the person may be prevented from reapplying for several months.

Even if there was a mistake made in the application process, it is not as simple as reapplying with the same insurance company or another. Depending on the situation, the person may be prevented from reapplying for several months.

How to Improve Your Chances of Approval

How to Improve Your Chances of Approval

While the underwriting process for Medicare supplement insurance can be strict, there are steps you can take to improve your chances of approval:

1. Maintain good health: Adopt a healthy lifestyle and manage any existing health conditions to demonstrate that you are a lower risk.

2. Consider alternative plans: If you’re facing difficulties with underwriting, explore alternative options, such as Medicare Advantage plans, which may have less stringent underwriting requirements.

3. Seek professional guidance: If you need clarification on the underwriting process or assistance with your application, consult a licensed insurance agent or broker who can provide tailored guidance.

Bottom Line: Mastering Medicare Supplement Underwriting

Navigating the world of Medicare supplement underwriting doesn’t have to be overwhelming. By understanding the basics of underwriting, the factors considered, and the common mistakes to avoid, you’ll develop your own medicare supplement underwriting cheat sheet. Research different plans, gather necessary documentation, and seek professional guidance. With these tools, you will have a checklist to go through during the underwriting process and find the Medicare supplement plan that best meets your needs. So, take control of your healthcare coverage and unlock the secrets of Medicare supplement underwriting by building your own cheat sheet.

Get Your Own Expert Medicare Underwriting Guide

At Omaha Insurance Solutions, we are happy to share with you our wealth of knowledge & experience with Medicare Supplement underwriting. Our Medicare Supplement underwriting cheat sheet was developed over a

Christopher J. Grimmond, MA, CFP

decade with thousands of clients. We have learned the lessons of Medicare Supplement underwriting.

The cost is EXACTLY the same whether you use an insurance agent or call the insurance company directly. The difference with us is you see all of the insurance companies and Medicare Supplements, not just one or two.

Our loyalty is to our clients, not to an insurance company. We can change companies on a dime.

And when your cost goes up, we are not going to say keep the policy. We are going to look for the same coverage with a solid A-rated company at a lower cost. If you can call the insurance company you have your policy with, I guarantee they will not recommend another insurance company.

We know the subtleties of the underwriting process and which company will be most favorable to your health situation. Not all companies are created equal, and we have learned the hard way over the years which ones to trust. You’ll get that experience with us.

Over the years, we’ve learned a thing or two about Medicare Supplements and underwriting. We also take care of all the paperwork, follow-up, and headaches that come with dealing with an insurance company. Call us for a free consultation at 402-614-3389.

Are you looking to maximize your healthcare coverage? In this article, we will explain the benefits of Medicare Advantage Part C, helping you make informed decisions about your healthcare options. Medicare Advantage Part C offers an alternative to traditional Medicare coverage, providing additional benefits and services to enhance your overall healthcare experience.

Are you looking to maximize your healthcare coverage? In this article, we will explain the benefits of Medicare Advantage Part C, helping you make informed decisions about your healthcare options. Medicare Advantage Part C offers an alternative to traditional Medicare coverage, providing additional benefits and services to enhance your overall healthcare experience.

With Medicare Advantage Part C, you can enjoy prescription drug coverage, vision and dental care, and even fitness programs. These additional services can save you money and provide comprehensive coverage tailored to your specific needs.

But how do you know if Medicare Advantage Part C is correct for you? We’ll explore the eligibility criteria and factors to consider when weighing your options. Understanding the ins and outs of Medicare Advantage Part C will empower you to make the best choice for your healthcare needs.

So, if you’re ready to take control of your healthcare coverage and get the most out of your benefits, keep reading. Let’s dive into the Medicare Advantage Part C world and discover the possibilities it holds for you.

Understanding the Basics of Medicare Advantage Part C Benefits

Medicare Advantage Part C, also known as Medicare Advantage Plans, is a comprehensive healthcare option offered by private insurance companies approved by Medicare. It combines the benefits of Medicare Parts A & B, and usually Part D, as well as additional services and coverage options. Medicare Advantage Part C is managed care, which means it is a network system. Doctors, hospitals, and clinics contract with the insurance company.

One of the key advantages of Medicare Advantage Part C is that it often includes prescription drug coverage, known as Medicare Part D, which is not included in Original Medicare. This means you can cover all your healthcare needs, including medications, under a single plan. Additionally, many Medicare Advantage plans offer extra benefits such as vision and dental care, hearing aids, and even fitness programs to help you stay healthy and active.

But how do you know if Medicare Advantage Part C is right for you? Let’s explore the eligibility criteria and factors when weighing your options.

The Benefits of Medicare Advantage Part C

Medicare Advantage Part C offers a wide range of benefits that can significantly enhance your healthcare coverage. These benefits can include:

include:

- Comprehensive coverage: Medicare Advantage Part C combines the benefits of Medicare Parts A and B, providing hospital insurance (Part A) and medical insurance (Part B) in one plan. This means you have coverage for hospital stays, doctor visits, preventive care, and more.

- Prescription drug coverage: Many Medicare Advantage plans include prescription drug coverage, allowing you to obtain your medications conveniently through the same plan. This can save you money and reduce the hassle of managing multiple insurance providers.

- Additional services: Medicare Advantage Part C plans often offer additional services not covered by Original Medicare, such as vision and dental care, hearing aids, and wellness programs. These services can help you maintain your overall health and well-being.

- Out-of-pocket cost protection: Medicare Advantage plans have a cap on out-of-pocket expenses, providing financial protection in case of unexpected medical costs. This can bring peace of mind and help you plan your healthcare budget more effectively.

How to Qualify for Part C

To be eligible for Medicare Advantage Part C, you must meet the following requirements:

To be eligible for Medicare Advantage Part C, you must meet the following requirements:

- Enrollment in Medicare Parts A and B: You must be enrolled in both Medicare Part A (hospital insurance) and Part B (medical insurance) to be eligible for Medicare Advantage Part C.

- Residency: You must reside in the service area of the Medicare Advantage plan you wish to join. Residency is important to remember. I have had clients move without telling me or the plan. They are then surprised when their coverage doesn’t work or is even canceled.

It’s important to note that eligibility requirements may vary depending on the specific Medicare Advantage plan and insurance provider. There are special needs plans for those on state Medicaid or with chronic health conditions like diabetes, COPD, or heart disease. These plans have additional requirements.

Review the requirements and seek guidance from a qualified insurance agent to ensure you meet the eligibility criteria. These plans have even richer benefits for those who qualify.

Differences Between Original Medicare Vs. Medicare Advantage

While Original Medicare and Medicare Advantage Part C both provide healthcare coverage, there are some key differences between the two:

- Coverage options: Original Medicare consists of Part A (hospital insurance) and Part B (medical insurance), while Medicare Advantage Part C combines both Parts A and B into a single plan. Medicare Advantage plans also often include additional benefits, such as prescription drug coverage and extra services.

- Network restrictions: Original Medicare allows you to go to any doctor or hospital that accepts Medicare, while Medicare Advantage plans typically have a network of providers you must use to receive full coverage. However, some Medicare Advantage plans offer out-of-network coverage for higher out-of-pocket costs.

- Cost structure: Original Medicare deductibles and coinsurance have no cap or maximum out-of-pocket. Many purchase

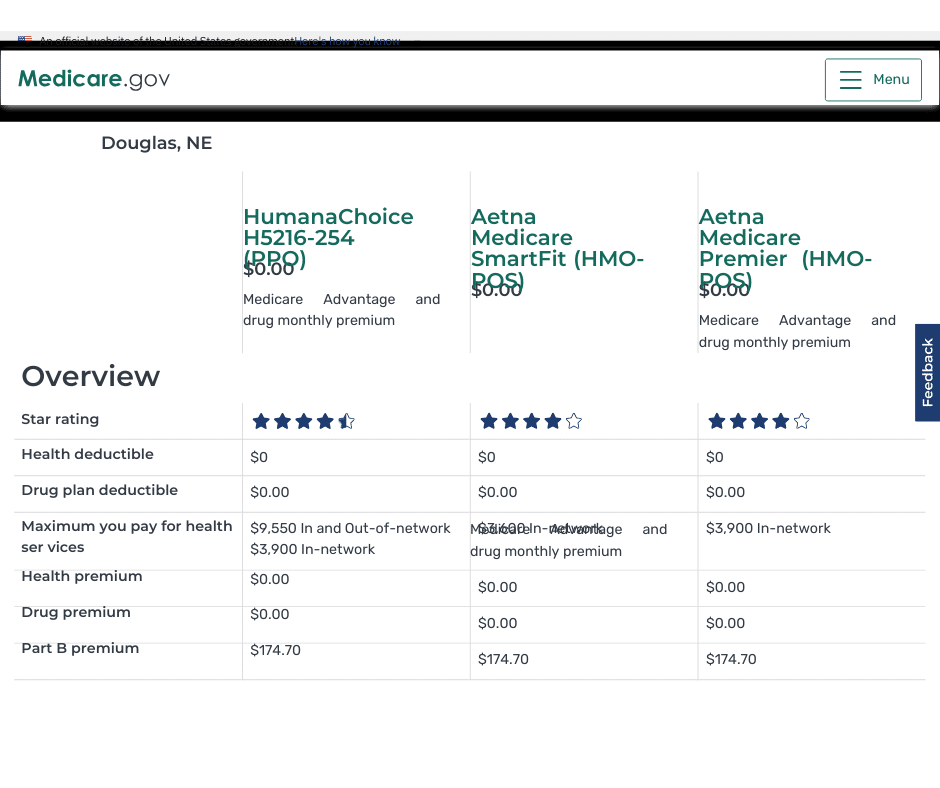

additional coverage—a Medigap plan—to cover the significant gaps in coverage. This additional insurance comes at an additional cost. Medicare Advantage has minimal copays with a maximum out-of-pocket as well as additional benefits. Most of the Medicare Advantage plans in the Omaha, Lincoln, and Council Bluffs area have zero monthly premium. You simply continue to pay your Medicare Part B premium, which you are paying anyway.

additional coverage—a Medigap plan—to cover the significant gaps in coverage. This additional insurance comes at an additional cost. Medicare Advantage has minimal copays with a maximum out-of-pocket as well as additional benefits. Most of the Medicare Advantage plans in the Omaha, Lincoln, and Council Bluffs area have zero monthly premium. You simply continue to pay your Medicare Part B premium, which you are paying anyway. - Flexibility: Original Medicare allows you to see any specialist or visit any healthcare provider without a referral. While some Medicare Advantage HMO plans in other parts of the country require referrals to see specialists, the Medicare Advantage plans in the Omaha, Lincoln, and Council Bluffs areas are open access. Open Access means you can see any specialist in the network without a referral.

Considering these differences can help you determine which type of coverage aligns best with your healthcare needs and preferences.

Choosing the Right Medicare Advantage Part C Plan

Choosing the right Medicare Advantage Part C plan requires careful consideration of your healthcare needs and personal preferences. Here are some factors to consider when selecting a plan:

Choosing the right Medicare Advantage Part C plan requires careful consideration of your healthcare needs and personal preferences. Here are some factors to consider when selecting a plan:

- Coverage and benefits: Review the coverage options and benefits offered by different Medicare Advantage plans. Consider your specific healthcare needs, such as prescription drugs, vision, and dental care, or fitness programs, and choose a comprehensive plan for your requirements.

- Provider network: Check whether the plan’s network includes your preferred doctors, hospitals, and specialists. Ensure the plan’s network is convenient and accessible for your healthcare needs. All four networks work with the Medicare Advantage plans in the Omaha, Lincoln, and Council Bluffs areas. If the provider is part of CHI, Nebraska Medicine, Methodist Health Systems, or Bryan Health, they will be in the network.

- Costs: Compare the costs associated with different Medicare Advantage plans, including monthly premiums, deductibles, copayments, and coinsurance. Consider your budget and evaluate which plan offers the most cost-effective coverage for your needs.

I recommend starting with the maximum out-of-pocket (MOOP) amount and the star rating. Maximum out-of-pocket is what you have at risk. The star rating can help you narrow down the plans that have been around for a while and have a good service record.

Researching and comparing different Medicare Advantage plans can help you select the best plan that aligns with your healthcare needs and budget. At Omaha Insurance Solutions, we help clients evaluate the universe of Medicare plans quickly & easily using our sophisticated but user-friendly software, and with over a decade of experience, we know the local Medicare plans intimately.

Exploring Additional Benefits

Medicare Advantage Part C plans often provide additional benefits that go beyond what Original Medicare offers. These benefits can vary depending on the specific plan and insurance provider, but commonly include:

- Vision and dental care: Many Medicare Advantage plans cover routine vision and dental services, including exams,

cleanings, and eyeglasses.

cleanings, and eyeglasses. - Hearing aids: Some plans offer coverage for hearing aids and related services, helping you maintain your hearing health.

- Fitness programs: Medicare Advantage plans may provide access to fitness programs, gym memberships, or wellness classes to help you stay active and improve your overall health. I belong to the Genesis Health Clubs in Omaha. My membership is almost $600 a year. I would be very happy to have my health insurance plan pay that fee. I’m looking forward to Medicare. In the Silver Sneakers and Renew Active Programs, you can actually join multiple gyms. You are not limited to one chain or a single club.

- Transportation services: Certain plans offer transportation services to and from medical appointments, ensuring you can get the care you need even if you don’t have reliable transportation.

These additional benefits can significantly enhance your healthcare experience and provide you with comprehensive coverage tailored to your specific needs. Original Medicare does not provide these benefits. If you want additional benefits, you must purchase them at additional costs.

Common Misconceptions about Medicare Advantage Part C

Common Misconceptions about Medicare Advantage Part C

There are several misconceptions surrounding Medicare Advantage Part C. Let’s address some of the most common ones:

- Limited provider choice: While provider networks are not an issue with the Medicare Advantage plans in the Omaha, Lincoln, and Council Bluffs areas, it certainly may be a concern in other places. There are typically, however, many options to choose from within most networks. Additionally, some plans offer out-of-network coverage for higher out-of-pocket costs.

- Lack of coverage for pre-existing conditions: Medicare Advantage plans cannot deny coverage based on pre-existing conditions. They must cover all services covered by Original Medicare, even if you have a pre-existing condition.

- Difficulty changing plans: Medicare beneficiaries have the opportunity to change their Medicare Advantage plans during the Annual Enrollment Period, which typically occurs from October 15th to December 7th each year. They also have a second opportunity during the Open Enrollment Period, which occurs from January 1st to March 31st, to make a one-time change to a Medicare Advantage plan.

- Higher costs: While Medicare Advantage plans have copays and coinsurance, these copays are generally small and have a cap. Medigap plans have a monthly cost that increases with age and usually exceeds annual copays on Medicare Advantage plans most of the time in most years.

Understanding these misconceptions can help you make informed decisions about Medicare Advantage Part C and ensure you have accurate information when considering your healthcare options.

Tips for Maximizing Your Medicare Advantage Part C Benefits

To make the most of your Medicare Advantage Part C benefits, consider the following tips:

- Review your plan annually: Medicare Advantage plans can change their coverage and benefits each year. Take the time to review your plan’s Annual Notice of Change (ANOC) to ensure it still meets your healthcare needs. Check the cost of medications for the coming year. We offer an annual review to our clients. However, some clients ignore our letters, emails, and phone calls to meet. We get distressed calls in the new year when plan changes catch up with some folks.

- Stay within your plan’s network: To receive full coverage and avoid higher out-of-pocket costs, use healthcare providers within your plan’s network. If you need to see a specialist or receive services outside the network, consult your plan’s guidelines for appropriate referrals or prior authorization. As I said earlier, this is generally not an issue in our area with doctors and hospitals; problems can arise with dentists and optimists who are not within the network. Double-check with the network because providers do change who they work with.

- Take advantage of additional benefits: Explore the extra benefits offered by your Medicare Advantage plan, such as vision and dental care or fitness programs. Utilizing these services can help you stay healthy and maximize the value of your plan. These Medicare Advantage Part C benefits save you money. I’m surprised when clients don’t utilize the over-the-counter benefit. In some cases, that is hundreds of dollars not coming out of your pocket.

- Understand your costs: Familiarize yourself with your plan’s copayments, deductibles, and coinsurance to avoid unexpected expenses. Knowing your costs upfront can help you budget for healthcare expenses more effectively. I always recommend clients talk with the doctor’s back office before any procedure is performed. Make sure the office received any prior approvals and find out the approximate cost to you beforehand so there are no surprises.

Following these tips can optimize your healthcare coverage and ensure you get the most out of your Medicare Advantage Part C plan.

Bottom Line: Making the Most of your Medicare Advantage Part C Benefits

Medicare Advantage Part C offers a comprehensive and flexible alternative to traditional Medicare coverage. With additional benefits such as prescription drug coverage, vision and dental care, and fitness

Christopher J. Grimmond, MA, CFP

programs, Medicare Advantage plans can provide you with comprehensive coverage tailored to your specific needs. Understanding the basics of Medicare Advantage Part C, eligibility criteria, and differences from Original Medicare is crucial in making informed decisions about your healthcare options.

By choosing the right Medicare Advantage Part C plan, exploring additional benefits, and maximizing your coverage, you can take control of your healthcare and enjoy comprehensive and cost-effective coverage.

If you’re ready to maximize your healthcare coverage and get the most out of your benefits, consider exploring the possibilities of Medicare Advantage Part C. Take charge of your healthcare journey today. Give us a call at Omaha Insurance Solutions at 402-614-3389 to view the Medicare Advantage Part C plans you are eligible for in your area to ensure a healthier and more secure future.

Is it overwhelming to choose the best Medicare plan for your needs? With so many options available, it’s understandable. But worry not because we have your ultimate solution – the Medicare Plan Comparisons Chart.

Is it overwhelming to choose the best Medicare plan for your needs? With so many options available, it’s understandable. But worry not because we have your ultimate solution – the Medicare Plan Comparisons Chart.

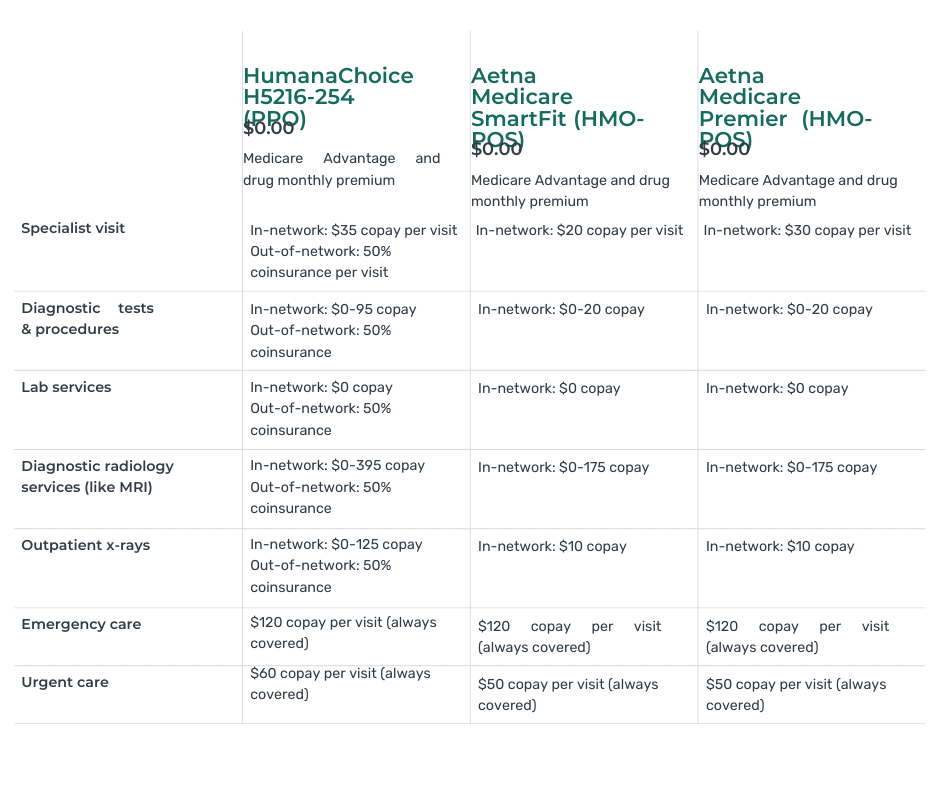

The best way to compare is side-by-side. We can see each relevant benefit or cost in chart form and compare apples to apples. There is still a lot of information to comb through and remember, but a chart helps to reduce some of the confusion and the mental work of remembering what each Medicare plan offers.

Whether you’re looking for a plan that covers prescription drugs, outpatient surgeries, or dental more favorably, you can look at your options in the Medicare plan comparison chart.

By utilizing this user-friendly chart, you can easily compare different plans side by side, evaluate their features and benefits, and make an informed decision based on your unique healthcare needs.

Choosing the right Medicare plan is crucial because it directly impacts your overall health and pocketbook. At Omaha Insurance Solutions, we aim to simplify your Medicare selection process by providing all the necessary information in one place. With a Medicare Plan Comparisons Chart, you can confidently select the plan that meets your specific requirements and enjoy peace of mind knowing that you have made the best choice for your healthcare coverage.

Understanding Medicare Plans

Medicare is a federal health insurance program that provides coverage for individuals aged 65 and older and younger individuals with certain disabilities. It consists of different parts, each covering specific services and treatments.

To understand which Medicare plan is best for you, it’s essential to familiarize yourself with the different types of plans available and their respective coverage options. This knowledge will enable you to make an informed decision based on your healthcare needs.

Types of Medicare Plans

There are four main types of Medicare plans: Original Medicare (Part A and Part B), Medicare Advantage (Part C), Medicare Supplement Insurance (Medigap), and Prescription Drug Coverage (Part D).

- Original Medicare (Part A and Part B): This is the traditional Medicare plan offered by the government. Part A covers hospital stays, skilled nursing facility care, and some home health services, while Part B covers doctor visits, outpatient care, and preventive services.

- Medicare Advantage (Part C): This is Medicare offered through a private insurance company approved by Medicare. It provides all the benefits of Original Medicare, along with additional coverage for prescription drugs, dental, vision, and hearing services.

- Medicare Supplement (Medigap) plans are designed to fill the gaps in Original Medicare coverage. They help pay for out-of-pocket costs such as deductibles, coinsurance, and copayments. Private insurance companies offer Medigap plans, which are standardized across the states.

- Prescription Drug Plans (Part D): Part D plans are standalone plans offered by private insurance companies. They provide coverage for prescription drugs and can be added to Original Medicare, Medicare Advantage, and some Medicare Cost Plans.

Medicare Plan Comparison Chart

The Medicare Plan Comparisons Chart is a powerful tool that allows you to compare different Medicare plans side by side. It provides a clear and concise overview of each plan’s coverage details, costs, and additional benefits.

Where Can You Find A Chart?

A public tool is on the Medicare website. Type Medicare.gov in your browser address bar and hit enter. You will be taken to the official Medicare website. Click on the button for “Find health & drug plans.” You can create your own account or just type in your zip code without creating an account.

Choose the type of plans you wish to compare: Medicare Advantage Plan (Part C), Medicare drug plan (Part D), or Medigap policy.

Click the button that applies to your situation. Do you get financial help with your plan or not? If you qualify, financial help would be from Nebraska or Iowa Medicaid. Have you qualified for EXTRA HELP? Click Next.

Prescription Drug Comparison

The tool will ask if you wish to include drug costs—type in the specific medications with the dosages.

You may use various filters, but before that, scroll down and look at the plans first. You can look at each plan individually and study the benefits and pricing. There is also a box to check “Add to compare” to examine the plans side-by-side. You are limited to 3 plans at a time.

At the bottom of the screen, you can see the plans’ names and a comparison button. Click the comparison button to bring them up on the screen. The plans will be placed side by side, and all the categories will be matched up between them.

You can see the similarities and differences between the plans in one place and make your determinations. The limitation is that the Medicare.gov software does not provide great detail about the plans individually or together.

At Omaha Insurance Solutions we use a propriety software that goes into much greater detail about each plan. You can see the most common medical plan details: doctor & specialist visits, inpatient & outpatient surgeries, skilled nursing stays, MRIs, and X-rays, etc., compared side-by-side and line by line. Medications are calculated in various totals and subtotals. The provider network search tool is right there to access and find out if your doctors are in the plan or not. We run hundreds of these Medicare plan comparison charts each year for the Medicare plans in the Omaha, Lincoln, & Council Bluffs areas. Contact us for a FREE comparison at 402-614-3389.

Medicare Plan Comparison Chart Interpretation

How do you interpret and analyze the information in front of you? Information can be overwhelming when there is a lot of it, and it is new and unfamiliar.

We help clients understand the information and how to weigh the various benefits, particularly in relation to their specific needs and ways of handling their health concerns.

Working with thousands of clients over many years with different health concerns that repeatedly ask many of the same questions, we have learned how to quickly assist you in evaluating and interpreting the information as it is relevant to your needs, situation, and budget.

The chart includes information such as monthly premiums, annual deductibles, coinsurance, copayments, and maximum out-of-pocket costs. It also highlights any limitations or restrictions that may apply to a plan.

By using the chart, you can quickly identify which plans offer the specific coverage you need. For example, if you require prescription drug coverage, you can quickly identify the plans that include Part D that cover your prescriptions at the most affordable prices. If you frequently travel and need coverage outside your local area, you can find plans that offer nationwide coverage.

Key Factors to Consider When Choosing a Medicare Plan

When comparing Medicare plans, there are several key factors to consider. These factors help you determine which plan best suits your needs and preferences. Here are some important considerations:

- Coverage: Evaluate each plan’s coverage options. Consider your existing health conditions and any specific treatments or services you anticipate needing in the future.

- Cost: Compare the costs associated with each plan, including premiums, deductibles, coinsurance, and copayments. Consider your budget and how much you can afford to pay for healthcare services.

- Provider Network: Check whether your preferred healthcare providers, such as doctors and hospitals, are included in the plan’s network. This ensures that you can continue receiving care from your trusted providers.

- Prescription Drug Coverage: If you take prescription medications, ensure the plan offers comprehensive coverage for the needed drugs. Review the formulary to see if your medications are included and at what cost.

- Additional benefits: Some Medicare plans offer additional benefits such as dental, vision, hearing coverage, OTC (Over-the-Counter) items, free gym memberships, and transportation. Consider whether these benefits are important to you and, whether they justify the additional cost, and which provide the maximum coverage.

How to Use the Medicare Plan Comparisons Chart Effectively

The Medicare Plan Comparisons Chart is designed to simplify choosing a Medicare plan. Here are some tips on how to use the chart effectively:

- Identify your healthcare needs: Before using the chart, take some time to assess your healthcare needs. Consider factors such as existing health conditions, prescription medications, and any specific treatments or services you anticipate needing in the future. This will help you narrow your options and focus on the plans that meet your requirements.

- Focus on relevant information: The chart provides detailed information about each Medicare plan, including coverage details, costs, and additional benefits. Focus on the information that is most relevant to your needs. For example, if you require prescription drug coverage, pay close attention to the details of Part D plans.

- Compare side by side: One of the greatest advantages of the chart is that it allows you to compare different plans side by side. This enables you to evaluate their features and benefits in a clear and concise manner. Take advantage of this feature to identify the plans that offer the specific coverage you need.

- Consider the cost: While coverage is necessary, it’s also essential to consider the cost associated with each plan. Evaluate factors such as monthly premiums, deductibles, copayments, and coinsurance. Consider your budget and how much you can afford to pay for healthcare services.

- Seek assistance if needed: If you find the process overwhelming or have specific questions about the chart or Medicare plans, don’t hesitate to seek assistance. Reach out to a licensed insurance agent or contact Medicare directly for guidance. Making an informed decision based on accurate and up-to-date information is important.

Bottom Line: Finding the Best Medicare Plan for Your Needs

Bottom Line: Finding the Best Medicare Plan for Your Needs

Choosing the best Medicare plan for your needs is a crucial decision that directly impacts your healthcare coverage and bank account. With the help of the Medicare Plan Comparisons Chart, you can simplify this process and make an informed decision based on your unique healthcare needs.

By understanding the different types of Medicare plans, comparing their coverage options, and considering key factors such as cost, provider networks, and additional benefits, you can confidently select the plan that meets your specific requirements.

Remember to utilize the Medicare Plan Comparisons Chart effectively, focusing on relevant information, comparing plans side by side, and considering both coverage and cost. If needed, seek assistance from

Christopher Grimmond

licensed insurance agents, or contact Medicare directly for guidance.

With the right Medicare plan in place, you can enjoy peace of mind, knowing that you have made the best choice for your healthcare coverage. We take people through this process daily. At no cost to you, we will show you the plans in your area that you are eligible for, break down the information on the chart, and match up with your unique needs and concerns. Call us at 402-614-3389 for a free consultation with a licensed insurance professional.

Are you confused about Medicare Part D health plans? Don’t worry, you’re not alone. Understanding your options can be overwhelming with all the jargon and complex rules. That’s why we’re here to demystify everything for you.

Are you confused about Medicare Part D health plans? Don’t worry, you’re not alone. Understanding your options can be overwhelming with all the jargon and complex rules. That’s why we’re here to demystify everything for you.

Whether you’re new to Medicare or have been enrolled for years, this article is designed to help you understand the key aspects of Part D plans, including what they cover, how they work, and how to choose the right plan for your needs.

We’ll also answer common questions, such as what medications are covered, how to find the most cost-effective plan, and how to navigate the dreaded coverage gap, known as the “donut hole.”

So, if you’re ready to tackle the confusion surrounding Medicare Part D health plans and take control of your healthcare, let’s dive in and get started.

Who is Eligible for Part D?

Medicare Part D is a prescription drug coverage program the federal government offers to Medicare beneficiaries. Before 2006, there were no government-sponsored prescription drug plans, and the cost of medications was becoming overwhelming for seniors. The Bush Administration introduced a partnership between Medicare and insurance companies known as Part D.

To be eligible for Medicare Part D, you must be enrolled in either Medicare Part A OR Part B. Part A covers hospital stays, while Part B covers doctor visits and outpatient services, but enrollment in either makes you eligible for the Medicare Part D prescription drug benefit.

Medicare Part D health plans are offered by private insurance companies approved by Medicare. These plans are available as standalone prescription drug plans (PDPs) or as part of a Medicare Advantage plan (Part C), which offer additional benefits beyond prescription drug coverage. You must have both Part A and Part B to be eligible for Part C.

Coverage Options and Costs Under Medicare Part D Health Plans

Coverage Options and Costs Under Medicare Part D Health Plans

Medicare Part D plans provide coverage for a wide range of prescription medications. Each plan has its own formulary, which is a list of covered drugs. Medicare regulations require the plan to have at least two drugs in each of the categories CMS (Center for Medicare & Medicaid Services) specifies. These formularies are divided into tiers, each with a different cost-sharing structure.

The costs associated with Medicare Part D plans can vary depending on your chosen plan. Several components to consider include the monthly premium, annual deductible, copayments or coinsurance, and coverage gap.

Premiums for Part D plans can vary widely, so it’s vital to compare plans to find one that fits your budget. In addition to the premium, many plans have an annual deductible that you must meet before many drug copays work. Once you’ve met the deductible, you’ll typically pay a copayment or coinsurance for each prescription.

It’s also important to be aware of the coverage gap, also known as the “donut hole.” The gap occurs when you reach a specific spending limit; then, your prescription drug costs increase significantly in many cases. However, the coverage gap is gradually closing, thanks to the Inflation Reduction Act legislation.

How to Choose the Right Medicare Part D Health Plan in Your Area

Choosing the right Medicare Part D plan can seem daunting, but with careful consideration, you can find a plan that meets your needs and budget. Here are some factors to consider when comparing plans:

- Coverage: Look for a plan that covers all essential medications. Each plan has its own formulary, so it’s important to review the list of covered drugs to ensure your prescriptions are included.

- Costs: Consider the monthly premium, annual deductible, copayments or coinsurance, and the coverage gap. Calculate how much you would pay out-of-pocket for your medications under each plan to determine which one offers the best value. The total cost is the critical comparison.

- Network: Check if your preferred pharmacies are in the plan’s network. Some plans have preferred pharmacies where you can get lower copayments or coinsurance.

When we run client’s medications, I am still amazed by the difference in cost from one pharmacy to another.

- Plan ratings: The Centers for Medicare and Medicaid Services (CMS) rates Medicare Part D plans on a five-star scale. These ratings can give you an indication of a plan’s quality and customer satisfaction.

By carefully evaluating these factors, you can narrow down your options and choose a Medicare Part D plan that best fits your needs.

Understanding the Different Tiers and Formularies

Medicare Part D formularies are divided into tiers, with each tier representing a different level of cost-sharing. The exact number of tiers can vary depending on the plan, but most plans have at least four tiers.

Tier 1 typically includes generic drugs and has the lowest cost-sharing. Tier 2 includes more expensive but still generic low-cost drugs. Tier 3 is for preferred brand-name drugs, followed by Tier 4 for non-preferred brand-name drugs. Tier 5 is usually reserved for specialty medications, with higher cost-sharing.

It’s important to note that not all drugs are covered on every plan’s formulary, and the specific drugs included in each tier can vary. Before enrolling in a Part D plan, reviewing the formulary to ensure your medications are covered and understanding the associated cost-sharing for each tier is essential.

My Experience with Medicare Part D Health Plans in Nebraska & Iowa

My Experience with Medicare Part D Health Plans in Nebraska & Iowa

We have over 2,000 Medicare clients at Omaha Insurance Solutions. During the Medicare Annual Election Period (Oct 15th—Dec 7th), we offer an annual review of clients’ plans, especially the medication part of their Medicare plan. Consequently, we run the medications for hundreds of clients through our Medicare Part D health plan software. It performs thousands of calculations and shows the plans in order of least expensive to most for overall cost. The numbers are broken down into various totals and subtotals by months and tiers for premiums and copays.

We put all the data on a big 42-inch screen for the clients to view. The software can easily manipulate the data, so clients can see which plans work best for their mix of medications, which pharmacies give the best pricing, and when and how much they may fall in the Medicare Gap (or “Donut Hole”) over the course of the year, if at all.

You quickly notice patterns after running thousands of simulations of Medicare Part D health plans during Annual Election Period in Nebraska and Iowa. You notice the same four or five plans at the top. Certain pharmacies consistently perform better for certain plans. You see the big differences in which insurance companies and plans are the winners in the new year compared to the previous year. Some inexpensive drugs are no longer covered under certain plans, or the price charged is totally out of proportion to the actual cost. From our experience of running our Part D analysis software for many years and for so many people, we quickly recognize patterns and can advise clients accordingly.

Tips for Saving on Medicare Part D

Prescription drug costs can add up quickly, but there are several strategies you can use to save money with your Medicare Part D plan. Here are some tips to consider:

- Generic drugs: Whenever possible, opt for generic medications. Generic drugs are just as effective as brand-name drugs but are often significantly cheaper.

- Mail-order pharmacy: Some Part D plans offer discounts for using a mail-order pharmacy. Mail-order can be a convenient and cost-effective way to get your medications delivered to your door.

- Medication reviews: Review your medications with your doctor or pharmacist to ensure you’re still taking the most appropriate and cost-effective drugs. They can also identify any potential drug interactions or duplications.

- Extra Help program: If you have limited income and resources, you may qualify for the Extra Help program, which helps cover the costs of prescription drugs.

By implementing these strategies, you can maximize your savings and ensure you get the most value from your Medicare Part D plan.

Common Misconceptions about Medicare Part D

Several common misconceptions surrounding Medicare Part D can lead to confusion and misinformation. Let’s debunk some of these myths:

- Myth: Medicare Part D covers all prescription drugs. Reality: Part D plans have formularies that only cover certain drugs. It’s crucial to review the formulary to ensure your medications are covered.

- Myth: You can switch plans anytime. Reality: You can only switch plans during the annual enrollment period or if you qualify for a special enrollment period.

- Myth: All Part D plans have the same costs and coverage. Reality: Part D plans can vary in terms of premiums, deductibles, copayments, and formularies. It’s important to compare plans to find the best fit.

- Myth: Medicare Part D health plans do not change much from year to year. Reality: Part D plans change, and in some cases, they change a lot.

By understanding these misconceptions, you can make more informed decisions about your Medicare Part D coverage.

Enrolling in a Medicare Part D Plan

Initial Enrollment Period

Enrolling in a Medicare Part D plan is relatively straightforward, but there are specific enrollment periods to be aware of. The Initial Enrollment Period (IEP) is the seven months surrounding your 65th birthday, including the three months before, the month of, and the months after your birthday.

Annual Enrollment Period

If you miss your IEP, you can enroll during the Annual Enrollment Period (AEP), which runs from October 15th to December 7th each year. During this period, you can switch plans or join a Part D plan for the first time.

Special Enrollment Periods

Special Enrollment Periods (SEPs) allow you to enroll outside the IEP or AEP if you experience certain qualifying events. There are many SEP types. One that is very common is when clients move out of their plan’s service area. Clients move and then call us because they have problems getting medications. “Yes, Medicare canceled your plan when you moved out of the area.”

To enroll in a Medicare Part D plan, contact the plans directly, call 1-800-MEDICARE, or call your agent.

If you call an insurance company, they will tell you one of their plans is best for you. They cannot see or sell you the other insurance companies and their plans.

The people you speak with at Medicare don’t work with insurance companies or Medicare plans. They don’t know the plans or how they work. It is like talking to a person who never worked on a car engine, and his only knowledge is from reading a manual and looking at diagrams.

They run the medications you give them through the software. Whatever the software tells them is what they tell you. They have no experience because they have no clients and get no feedback on the advice they are dispensing. There are no consequences to them if they give bad advice. They will never talk to the same person again. They can recommend anything without being held responsible for the advice dispensed. Insurance agents can be held responsible and are.

The Only Way to Get the Information to Make A Truly Informed Choice

I highly recommend working with a trusted and experienced insurance professional who is independent. In other words, an independent agent or broker can show you most or all of the Medicare Part D health plans in your area and the Medicare Advantage plans with prescription drugs. You want to be confident in the person’s knowledge and expertise. Almost anyone can get an insurance license. The person you use should demonstrate knowledge and expertise to you about Medicare and the various insurance plans. They should display reliability. Those are the people to trust. Think about how you pick a doctor.

All Medicare Part D Health Plans and Advantage Plans Are Local

Plans vary from state to state and region to region. At Omaha Insurance Solutions, we are intimately acquainted with the 21 Medicare Part D plans in Nebraska & Iowa, the 30 Medicare Advantage plans in Nebraska, and the 25 Medicare Advantage plans in Iowa. Clients give us daily feedback on how well or poorly the various companies and plans are performing at any given time. We are familiar with our local networks–CHI Health, Nebraska Medicine, Methodist Health Systems, and Bryan Hospital–and other providers. My home is down the street from MD West One. I have had multiple surgeries myself at OrthoNebraska. We know well the Medicare Advantage and Part D plans in Omaha, Lincoln, and Council Bluffs and the doctors and institutions that work with them.

Nebraska, and the 25 Medicare Advantage plans in Iowa. Clients give us daily feedback on how well or poorly the various companies and plans are performing at any given time. We are familiar with our local networks–CHI Health, Nebraska Medicine, Methodist Health Systems, and Bryan Hospital–and other providers. My home is down the street from MD West One. I have had multiple surgeries myself at OrthoNebraska. We know well the Medicare Advantage and Part D plans in Omaha, Lincoln, and Council Bluffs and the doctors and institutions that work with them.

Clients often call us asking for help navigating the customer service bureaucracy when they encounter problems. We constantly hear what is working and not with Medicare Part D health plans in the Omaha, Lincoln, and Council Bluffs areas. We do three-way phone calls with the insurance provider, the pharmacies, and clients to get problems solved. Sometimes, we connect the billing departments of one of the networks with the insurance company and make sure they are communicating correctly so a client is not billed incorrectly.

Unlike the SHIP office or other volunteer organizations that help seniors with Medicare, we find out directly from clients how well Medicare and the Medicare insurance plans are serving them.

Frequently Asked Questions About Medicare Part D

- Question: What medications are covered under Medicare Part D?

Answer: Part D plans cover a wide range of prescription drugs, including generic and brand-name medications. Each plan has its own formulary, so it is essential to review the list of covered drugs.

- Question: How do I find the most cost-effective Part D plan?

Answer: To find the most cost-effective plan, consider factors such as monthly premiums, deductibles, copayments or coinsurance, and the coverage gap. Use the Medicare Plan Finder tool to compare plans based on your specific medications and needs.

Our propriety software sorts through all the plans in your area, confirm the medications on the formulary, lists the copays and premiums, totals the amounts, and reveals the star rating. I believe the information is presented in a much friendlier format than Medicare’s Plan Finder. We perform the service for FREE. Medicare and the insurance companies compensate the agents.

- Question: What is the coverage gap or “donut hole”?

Answer: The coverage gap temporarily increases prescription drug costs after reaching a certain spending limit. However, it is gradually disappearing.

- Question: Can I get assistance paying for my Medicare Part D plan?

Answer: If you have limited income and resources, you may qualify for the Extra Help program, which provides financial assistance to cover the costs of prescription drugs.

Conclusion: The Importance of Understanding Medicare Part D

Medicare Part D health plans play a crucial role in helping seniors and individuals with disabilities afford their prescription medications. By understanding the in’s and out’s of Part D plans, you can make informed decisions about your healthcare coverage and ensure you get the most value from your plan.

Christopher J. Grimmond, MA, CFP

This guide has given you the knowledge you need to demystify Medicare Part D, from knowing what medications are covered to navigating the different tiers and formularies. Remember to review your options, compare plans, and consider cost-saving strategies to maximize your savings.

Don’t let the confusion surrounding Medicare Part D hold you back from taking control of your healthcare. With the right plan and information, you can confidently navigate the world of Medicare Part D and ensure you have access to the medications you need.

If you want assistance and objective analysis of your area’s Medicare Part D health plans, contact us at [email protected] and 402-614-3389. We will provide you with unbiased and free advice on the Medicare plans that will work for you.

Are you wondering if your Medicare Part D plan covers Xarelto? Well, you’re in the right place! This article will unlock the benefits and examine whether Medicare Part D pays for Xarelto.

Xarelto is a widely prescribed anticoagulant medication used to prevent blood clots. It is commonly prescribed for conditions such as atrial fibrillation, deep vein thrombosis, and pulmonary embolism. Xarelto is also a very expensive medication. Even with Medicare insurance, the copays are high, especially in the Gap phase of Part D.

Navigating the intricacies of Medicare coverage can add an additional level of complexity and confusion around prescription drugs.

Medicare Part D is a prescription drug plan offered by private insurance companies approved by Medicare. The program aims to provide affordable access to various medications, but not all drugs are covered. That’s why it’s crucial to understand whether Xarelto is included in the formulary of your specific Part D plan.

I have hundreds of Medicare clients on Xarelto. We run our clients’ medications through our proprietary software to determine the lowest-cost drug plans. We want the plans to have at least a 3-star or higher Medicare rating. Xarelto is one of many high-dollar medications we have had to deal with for over a decade. This article will delve into Medicare Part D coverage details and explain how we find plans that cover our clients’ Xarelto and other costly medications. So, let’s start unlocking the benefits of Medicare Part D and discovering if Xarelto is covered under your plan.

Understanding Xarelto and Its Importance

Understanding Xarelto and Its Importance

Xarelto, also known by its generic name rivaroxaban, is an oral anticoagulant medication that plays a crucial role in preventing blood clots. Blood clots can lead to serious health complications such as stroke, heart attack, or even death. Xarelto works by inhibiting the clotting factors in the blood, reducing the risk of clot formation.

The use of Xarelto is particularly prevalent among individuals with conditions such as atrial fibrillation, deep vein thrombosis, and pulmonary embolism. Atrial fibrillation is an irregular heart rhythm that can increase the risk of blood clots forming in the heart. Deep vein thrombosis occurs when blood clots form in the deep veins of the legs, while pulmonary embolism is a life-threatening condition where a blood clot travels to the lungs.

Given the importance of Xarelto in managing these conditions, individuals must have access to affordable medication. This is where Medicare Part D comes into play, offering coverage for prescription drugs to Medicare beneficiaries. Let’s explore the coverage options under Medicare Part D and how they relate to Xarelto.

Coverage Options Under Medicare Part D

Medicare Part D provides coverage for prescription drugs through private insurance companies that contract with Medicare. There are 21 Medicare Part D plans in the Omaha, Lincoln, and Council metro areas. These plans are designed to offer affordable access to a wide range of medications, including Xarelto. As of the writing of this article (January 2024), all 21 Medicare Part D plans pay for Xarelto. However, it’s important to note that not all Part D plans cover every prescription drug.

These plans are designed to offer affordable access to a wide range of medications, including Xarelto. As of the writing of this article (January 2024), all 21 Medicare Part D plans pay for Xarelto. However, it’s important to note that not all Part D plans cover every prescription drug.

Each Medicare Part D plan has a formulary, which is a list of covered drugs. The formulary is divided into different tiers, each with a different cost-sharing structure. Xarelto may be included in the formulary, but its placement within the tiers can affect how much you must pay out of your pocket.

Typically, Part D plans place drugs in different tiers based on their cost and how they compare to other medications in terms of safety and effectiveness. The lower the tier, the lower your out-of-pocket costs will be. It’s worth noting that the formulary and tier structure can vary between different Part D plans, so reviewing your plan’s specific details is essential to determine if Xarelto is covered and at what cost.

How to Determine if Xarelto is Covered Under Your Medicare Part D Plan

How to Determine if Xarelto is Covered Under Your Medicare Part D Plan

You have a few options to determine if Xarelto is covered under your specific Medicare Part D plan. The first step is to review the plan’s formulary. You can usually find this information on the plan’s website or request a copy of the formulary from the insurance company.

When reviewing the formulary, look for Xarelto or its generic equivalent, rivaroxaban. Note the tier in which it is placed and the associated cost-sharing requirements. Remember that formularies can change from year to year, so reviewing the most up-to-date information is essential.

Another helpful resource is the Medicare Plan Finder tool the Centers for Medicare & Medicaid Services (CMS) provides. This online tool allows you to enter your zip code, current medications, and dosage information to compare different Part D plans in your area. The tool will provide a list of plans and estimated costs. You will learn whether Xarelto is covered and the monthly costs.

If you prefer a more personalized approach, contact the insurance company directly and speak with a representative. They can provide detailed information about your plan’s coverage for Xarelto, including any prior authorization requirements or restrictions.

We Can Help Unlock Your Part B Benefits

Like Medicare, Omaha Insurance Solutions uses a plan finder tool that reviews all the Part D plans, formularies, and prices. The tool shows the various plans, the drug tiers, the medication cost before the Gap (Donut Hole) and in the Gap (Donut Hole), and the total overall cost combining copays and premiums together. You will have a total annual cost for each plan, so you can compare. We also point out the plan’s Medicare star rating.

We can filter the Part D information in many ways so you can look at the data as it applies to you. Our service is free when you are a client. We do this every year during the Annual Election Period for our clients to ensure they are on the best plan for their medication needs and budget.

Researching and understanding your plan’s coverage for all your medications, including Xarelto, can help you make informed decisions about your healthcare and potentially save you money. But what should you do if your Part D plan does not cover Xarelto? Let’s explore the steps you can take in such a situation.

Steps to take if your plan does not cover Xarelto

If your Medicare Part D plan does not cover Xarelto, don’t panic. You can take several steps to explore alternative options and potentially lower your out-of-pocket costs.

1. Speak with your healthcare provider: Your healthcare provider can help you explore alternative medications covered by your plan or suggest other strategies to manage your condition effectively.

2. Request a formulary exception: Sometimes, your healthcare provider can submit a request to the insurance company for a formulary exception. This request outlines why Xarelto is medically necessary for you and provides supporting documentation. If the exception is approved, the insurance company may cover Xarelto, even if it’s not on the formulary.

3. Consider therapeutic alternatives: Your Part D plan may cover alternative medications within the same class as Xarelto. These medications work similarly to Xarelto and may be suitable for your condition. Your healthcare provider can guide you in exploring these alternatives.

4. Explore patient assistance programs: Pharmaceutical companies often offer patient assistance programs that provide financial assistance or free medication to individuals who meet specific eligibility criteria. Due to its high cost, these programs can be a valuable resource if you need help to afford Xarelto.

5. Review other Part D plans: If Xarelto is essential for your health and well-being, consider switching to a different one during the annual enrollment period, typically from October 15th to December 7th each year. By reviewing other plans, you may find one that covers Xarelto or offers more favorable coverage for your specific needs.

Remember, it’s crucial to consult with your healthcare provider and insurance company before changing your medication regimen or coverage. They can provide personalized guidance based on your specific health condition and insurance coverage.

Alternative options for accessing Xarelto at a lower cost

If Xarelto is not covered by your Medicare Part D plan or the out-of-pocket costs are prohibitively high, alternative options are available to access Xarelto at a lower cost.

If Xarelto is not covered by your Medicare Part D plan or the out-of-pocket costs are prohibitively high, alternative options are available to access Xarelto at a lower cost.

1. Generic alternatives: Generic versions of Xarelto, known as rivaroxaban, may be cheaper. Generic drugs contain the same active ingredients as their brand-name counterparts and are approved by the FDA as safe and effective. Speak with your healthcare provider and pharmacist to explore whether a generic alternative suits you.

2. Manufacturer discounts and coupons: The pharmaceutical manufacturer may offer discounts or coupons that can help reduce the cost of the medication. These savings programs are often available for eligible individuals who meet specific criteria. Check the manufacturer’s website or discuss these programs with your healthcare provider.

3. Medication assistance programs: Non-profit organizations and foundations may offer medication assistance programs that provide financial support or free medication to individuals in need. These programs often have specific eligibility criteria, so it’s important to research and understand the requirements before applying.

4. Pharmacy discount programs: Some pharmacies, including Xarelto, offer discount programs or savings cards to help lower prescription medication costs. These programs may provide discounts for individuals paying out-of-pocket or even those with insurance coverage.

It’s worth noting that while these alternative options can help reduce the cost of Xarelto, it’s important to discuss them with your healthcare provider and consider their recommendations. They can provide valuable insights based on your specific health condition and medication needs.

Tips for Maximizing your Medicare Part D coverage for Xarelto

To maximize your Medicare Part D coverage for Xarelto, consider the following tips:

1. Review your plan annually: Medicare Part D plans can change their formularies and coverage yearly. Take the time to review your plan’s coverage during the annual enrollment period with your agent to ensure Xarelto is still covered and assess any potential changes in cost-sharing requirements. From October 15th to December 7th, we work around the clock to ensure our clients’ medications are covered in their Part D or Medicare Advantage plan within their budget.

ensure Xarelto is still covered and assess any potential changes in cost-sharing requirements. From October 15th to December 7th, we work around the clock to ensure our clients’ medications are covered in their Part D or Medicare Advantage plan within their budget.

2. Consider the total cost: When evaluating different Part D plans, Don’t solely focus on the monthly premium- this is a very common mistake. Consider the deductible, copayments, and coinsurance, as these factors can significantly impact your out-of-pocket costs for Xarelto.

Total Annual Cost! Not just copays, or t just monthly premiums. Not just the cost outside the donut hole. It is the total annual cost you pay.

3. Utilize preferred pharmacies: Some Part D plans have preferred pharmacy networks to access medications at lower copayments. Check if your plan has a preferred pharmacy network, and consider utilizing these pharmacies to reduce your medication costs. I have had clients save hundreds and

4. Explore mail-order options: Mail-order pharmacies often offer discounted prices for prescription medications, including Xarelto. If your plan allows for mail-order prescriptions, it may be worth considering this option to save on your medication costs.

By staying proactive and informed, you can maximize your Medicare Part D coverage and ensure affordable access to Xarelto.

Common Misconceptions about Medicare Part D Coverage for Xarelto

There are several common misconceptions about Medicare Part D coverage for Xarelto that are important to address:

There are several common misconceptions about Medicare Part D coverage for Xarelto that are important to address:

1. All Part D plans cover Xarelto: Not all Part D plans cover Xarelto, and its coverage can vary depending on the plan. Review your specific plan’s formulary to determine if Xarelto is covered and at what cost is essential.

2. Coverage is the same across all Part D plans: Xarelto’s coverage and cost-sharing requirements can vary between different Part D plans. It’s crucial to compare the formularies and associated costs of various plans to find one that suits your needs.

3. Once covered, Xarelto will always be covered: Formularies can change annually, and a medication covered in the past may not be covered in the future. Reviewing your plan’s formulary annually during the annual enrollment period is vital to ensure Xarelto is still covered.

This Medicare mistake is the bane of my existence. Some clients do not take the annual review period seriously. They do not send us an updated list of medications. They do not talk with us, and when January comes—and it is too late—they call because a particular medication is not covered or the cost is significantly higher than the previous year.

4. Generic alternatives are always covered: While generic alternatives are often less expensive, they may not be covered by all Part D plans. Reviewing your plan’s formulary is crucial to determine if the generic version of Xarelto is covered.

By dispelling these misconceptions, you can approach your Medicare Part D coverage for Xarelto with a clear understanding of what to expect and how to navigate the system’s complexities.

Resources and Assistance Programs for Xarelto Users

If you need assistance accessing Xarelto or managing the cost of the medication, several resources and assistance programs can provide support:

1. Extra Help/Low-Income Subsidy: The Extra Help program is a federal program that helps individuals with limited income and resources pay for their Medicare prescription drug costs. Eligible individuals can receive assistance with premiums, deductibles, and copayments. To determine if you qualify for Extra Help, contact the Social Security Administration or visit their website.